Saudi crude shipments to India are set to reach their highest level since 2020 this month, narrowing the gap with Russian supplies as New Delhi faces ongoing US pressure to reduce its purchases of Russian oil, according to data from Kpler cited by Bloomberg on Friday.

Flows from Saudi Arabia are projected at between 1 million and 1.1 million barrels per day (bpd), Kpler lead research analyst Sumit Ritolia said, describing the volumes as the strongest since November 2019, bringing Saudi exports broadly in line with Russian deliveries.

Kpler estimates Russian crude shipments to India at around 1.2 million bpd this month, which would keep Moscow as India’s largest supplier, though at levels well below the more than 2 million bpd seen at peak periods over the past three years.

For March, Kpler forecasts Russian flows easing further to between 800,000 and 1 million bpd, noting that such a drop could allow Saudi Arabia to retake the top spot if Indian refiners keep replacing Russian crude with Saudi shipments.

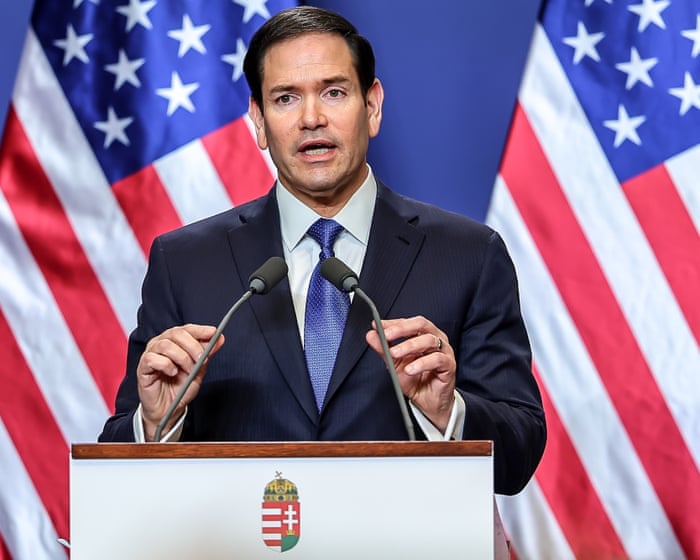

In early February, US President Donald Trump announced a trade deal with India that linked tariff reductions to India halting purchases of Russian crude oil.

He said he would cut punitive tariffs on Indian goods in exchange for Prime Minister Narendra Modi’s agreement that India would stop buying Russian oil. He even suggested New Delhi would increase purchases of US – and potentially Venezuelan – oil.

Current import levels indicate that Indian buyers have not moved abruptly to cut Russian intake.

India emerged as a major buyer of Russian crude after the 2022 invasion of Ukraine, when discounted barrels diverted from Europe were rerouted to Asian markets – meaning that any loss of market share in India would shrink one of Moscow’s main export outlets.

Meanwhile, as Indian spot purchases soften, China's imports of Russian oil are on track for a record month.

Russian share of India's January oil imports lowest since late 2022, data shows

— Economic Times (@EconomicTimes) February 18, 2026

https://t.co/w6wClXRX1Z

Data from Vortexa and Kpler, cited by Reuters, shows Chinese inflows at roughly 2.07–2.08 million bpd in February, underscoring a shift in trade patterns rather than a collapse in overall Russian exports.